The "Conservatorship Era" began in September 2008 when Fannie Mae and Freddie Mac entered conservatorship under the FHFA, with Treasury stepping in via the Senior Preferred Stock Purchase Agreements (PSPAs). Let’s trace the capital structure’s evolution, focusing on the senior preferred stock’s liquidation preference and the key amendments made over the years.

Pre-Conservatorship Capital Structure (Immediately Prior to 2008)

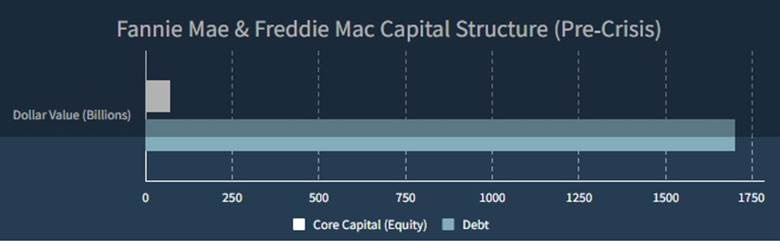

Common Shares: Fannie Mae had ~1.31 billion outstanding; Freddie Mac ~647 million.

Junior Preferred Stock: $34.6 billion par value combined ($20.7B Fannie, $13.9B Freddie).

Debt: ~$1.7 trillion combined ($870B Fannie, $830B Freddie).

Capital Ratio: Mandated at 2.5% for on-balance-sheet assets and 0.45% for guarantees, but effective capital was closer to 0.45% of total risk exposure due to off-balance-sheet leverage, leaving them undercapitalized at under $70 billion combined.

Initial Conservatorship and PSPAs (2008)

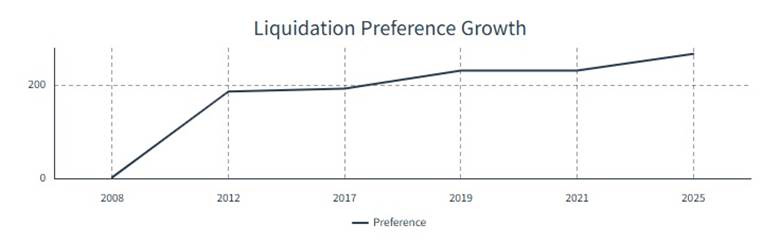

Treasury bought $1 billion of senior preferred stock per GSE ($2B total) with a 10% dividend, plus a commitment to inject up to $200 billion each as needed. By 2012, draws totaled $187.5 billion ($116.1B Fannie, $71.3B Freddie), setting the liquidation preference—the amount Treasury gets first in a wind-down—at $187.5 billion. Warrants for 79.9% of common stock were also issued.

The Net Worth Sweep (2012 Amendment)

The Third Amendment (August 17, 2012) replaced the 10% dividend with a full net worth sweep, sending all profits above a small buffer to Treasury. The dividends paid to Treasury over the years has totaled over $303 billion. There was no increase in the $187.5 billion liquidation preference during this period, as there was no drawdown. But no adjustments down for the dividends paid either – despite all profits going to the treasury after this amendment.

Later Adjustments (2017–2021) and Senior Preferred Increases

Here’s where the senior preferred stock’s liquidation preference grows due to retained capital:

2017 Amendment ($3B Buffer): Announced December 21, 2017, effective Q1 2018, each GSE could retain a $3 billion buffer before sweeping profits. To compensate Treasury for forgoing dividends on this amount, the PSPAs increased the liquidation preference by $3 billion per GSE ($6B total). So, by 2018, it rose from $187.5B to $193.5B ($119.1B Fannie, $74.3B Freddie).

2019 Amendment ($25B/$20B Buffers): Announced September 30, 2019, effective Q4 2019, Fannie could retain up to $25 billion and Freddie $20 billion, replacing the $3B cap. The amendment specified that “as compensation for taxpayers forgoing cash dividends,” the liquidation preference would increase by the additional capital retained—$22 billion for Fannie ($25B - $3B) and $17 billion for Freddie ($20B - $3B), totaling $39 billion. This bumped the preference from $193.5B to $232.5B ($141.1B Fannie, $91.4B Freddie) as the GSEs built these buffers (fully reached by 2020 per their 10-Ks).

2021 Amendment (Cap Removal): Announced January 14, 2021, effective post-Collins v. Yellen Supreme Court ruling (June 2021), this removed the $25B/$20B caps, allowing the GSEs to retain capital up to FHFA’s regulatory minimums (e.g., 4% of assets, or ~$283B combined per 2020 FHFA rules). The liquidation preference continued to rise dollar-for-dollar with retained earnings until hitting this “capital reserve end date.” By March 2025, Fannie reports $47B and Freddie $34B in retained equity (2024 10-Ks), adding $36B more ($47B - $25B = $22B Fannie; $34B - $20B = $14B Freddie) since 2019, pushing the liquidation preference to $268.5B ($163.1B Fannie, $105.4B Freddie).

Current State (March 2025)

Senior Preferred Stock: Liquidation preference is now $268.5 billion, reflecting the $187.5B drawn plus $81B from retained capital ($6B in 2017, $39B in 2019, $36B post-2021). Dividends paid to Treasury (~$303B) don’t affect this figure.

Retained Capital: $81 billion total ($47B Fannie, $34B Freddie), building incrementally with profits generated each quarter.

Junior Preferred: $34.6B par value, still junior to the swollen senior preferred claim.

Common Stock: Greatly diluted because of the Treasury’s warrants and the Senior Preferred stock.

Note: The 2017 and 2019 amendments explicitly tied liquidation preference increases to retained capital as a trade-off for skipping dividends, and the 2021 amendment unleashed this mechanism further by lifting caps, aligning with recapitalization goals under FHFA Director Calabria.

Junior vs. Senior Preferred (2020 CBO Report)

The 2020 Congressional Budget Office (CBO) report, updated in December 2024, suggested that in a hypothetical recapitalization, junior preferred stock ($34.6 billion par value) could be treated as "senior" to Treasury’s senior preferred stock in terms of repayment priority. This isn’t a legal fact—it’s an analytical opinion. The PSPAs explicitly rank Treasury’s senior preferred above all other claims. The CBO argued that if the GSEs were recapitalized and released, junior preferred holders might negotiate priority over Treasury’s $187.5 billion to incentivize private investment, given their pre-conservatorship status. Legally, though, Treasury’s position remains senior unless a future deal restructures it. This remains a point of contention in litigation and reform debates.

Current State:

Today, the capital structure is still dominated by Treasury’s senior preferred stock, with a liquidation preference of $187.5 billion plus accumulated dividends dwarfing all else. Junior preferred stock (par value around $33 billion combined) and common stock exist but are effectively worthless unless conservatorship ends and capital is restored. The GSEs have no real equity cushion—any major loss could force another Treasury draw, though their profitability (tied to mortgage guarantee fees) keeps them afloat operationally.

The evolution reflects a tension: the government wanted stability and taxpayer protection, but shareholders argue it stripped them of value. This sets the stage for the litigation battles—let’s pivot there next.